Construction Loan Guide: Getting A Builders Mortgage In Canada

Making sense of construction financing

Are you thinking about building your dream home? Then it’s time to learn all about construction loans. And trust us—getting a builders mortgage isn’t as complicated as you think!

A construction loan is your key to accessing the funds you need to build a home that ticks every one of your boxes. In this guide, we’ll take you through everything you need to know about the exciting process ahead—from submitting your initial application to walking into your new home on move-in day. Let’s dive in.

What is a construction mortgage?

“A lot of people look at construction loans as some kind of mystical unicorn in lending and, in reality, it's not that complicated,” shares Alex McFayden, Founding Partner of Thrive Mortgage Co. “There is a specific series of steps to it. If followed correctly, you will have a great experience.”

A construction loan is a short-term way to access funds to build a home from the ground up. Importantly (and the name itself may lend a clue), a construction mortgage is a type of loan that solely finances the construction of the home. Throughout the building process, the funds are typically disbursed based on reaching certain construction milestones.

How does a construction mortgage differ from a regular mortgage?

Construction mortgages will carry higher rates than regular mortgages due to the greater risk incurred on the part of the lender. After all, building a home is a complex & long process, and is no stranger to running into delays or unforeseen road blocks. In turn, construction mortgages are often harder to obtain than regular mortgages as well.

Reviewing your financing options

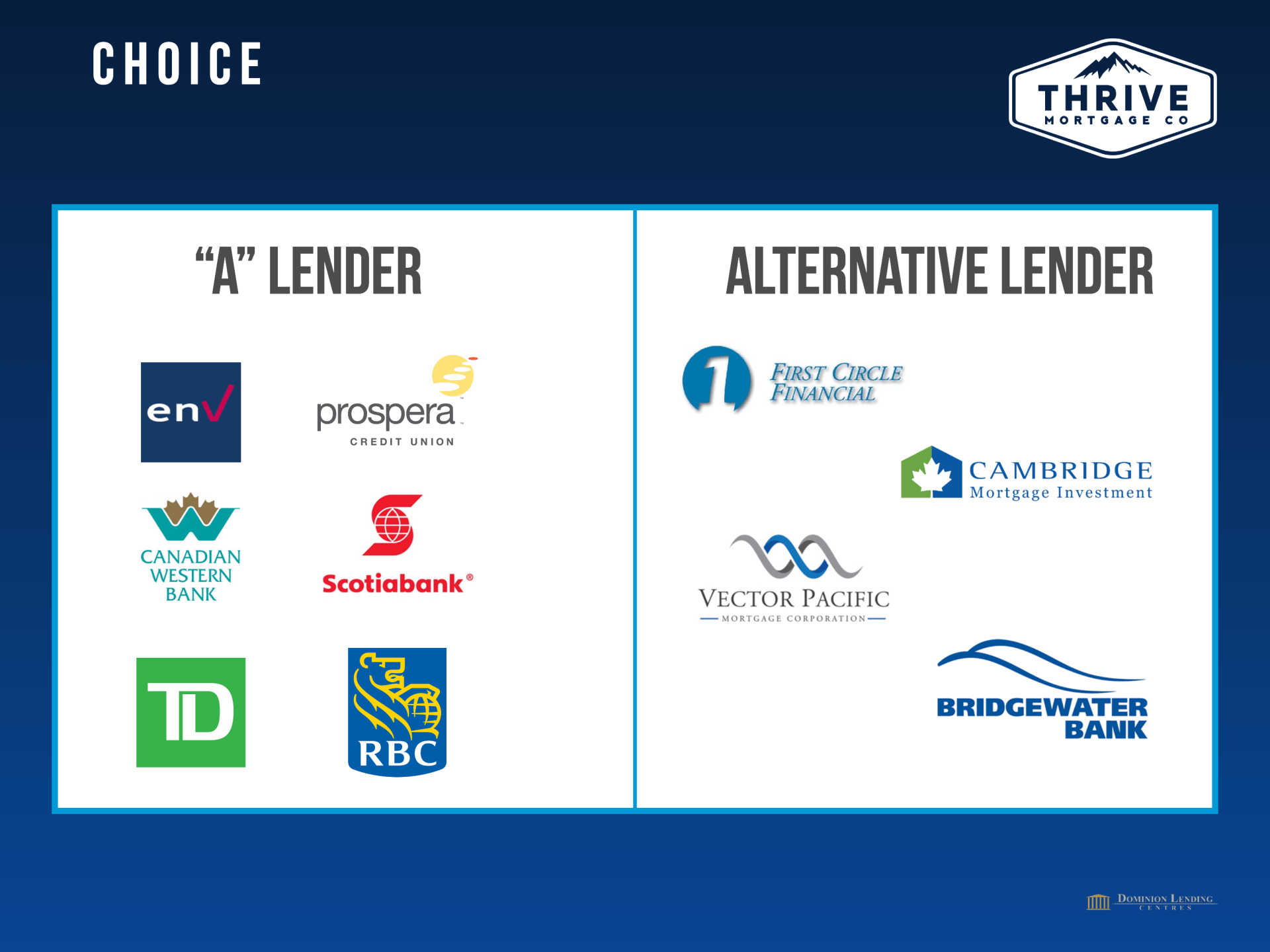

When it comes to choosing a lender for your construction mortgage, private lenders offer significantly more flexibility. However, they also generally carry higher interest rates than traditional lenders. Below, we break down the two options for financing your construction mortgage.

How do private lenders differ from traditional lenders?

Traditional lenders, or an “A lender”, are generally banks or credit unions that offer the lowest rates. Because they’re federally regulated, this means that the restrictions applied to who they grant loans to are extremely strict. Borrowers must have solid credit scores, stable employment income, and a minimum of a 5% down payment.

Private lenders, or alternative lenders, are individuals or small companies that provide mortgages on a short-term basis and do not need to follow the strict requirements imposed by the government on who they can qualify for a mortgage.

When should I use a private lender?

”There are a lot of reasons to proceed with a private lender—especially when it comes to construction mortgages,” explains Dean Lawton, Founding Partner of Thrive Mortgage Co. “What we’ve found, and many industry experts and builders agree, is that construction projects typically get stalled because of financing. In this case, alternative lenders are much more flexible to deal with. That’s why we often proceed with the construction portion of a mortgage with alternative lenders over a bank.”

Generally, once a construction is complete and a home is move-in ready, you’ll transition to your traditional mortgage. However, when you’re in the thick of building, conventional institutions’ construction programs don’t offer the same kind of flexibility or deep understanding as qualified private lenders. When you run into a construction delay—which is nearly inevitable with building a home—a bank will slow down the entire process due to rigid protocols, costing you more money along the way.

As a result, despite the higher rates that private lenders provide, they actually provide you with the immediate access to funds that you may need during construction. Plus, they typically grant you a higher qualification than you would ever typically receive with a bank, which means that you’ll have a greater pool of funds to tap into throughout the process.

In turn, private lenders can actually save you money in the long run.

What is a construction draw mortgage?

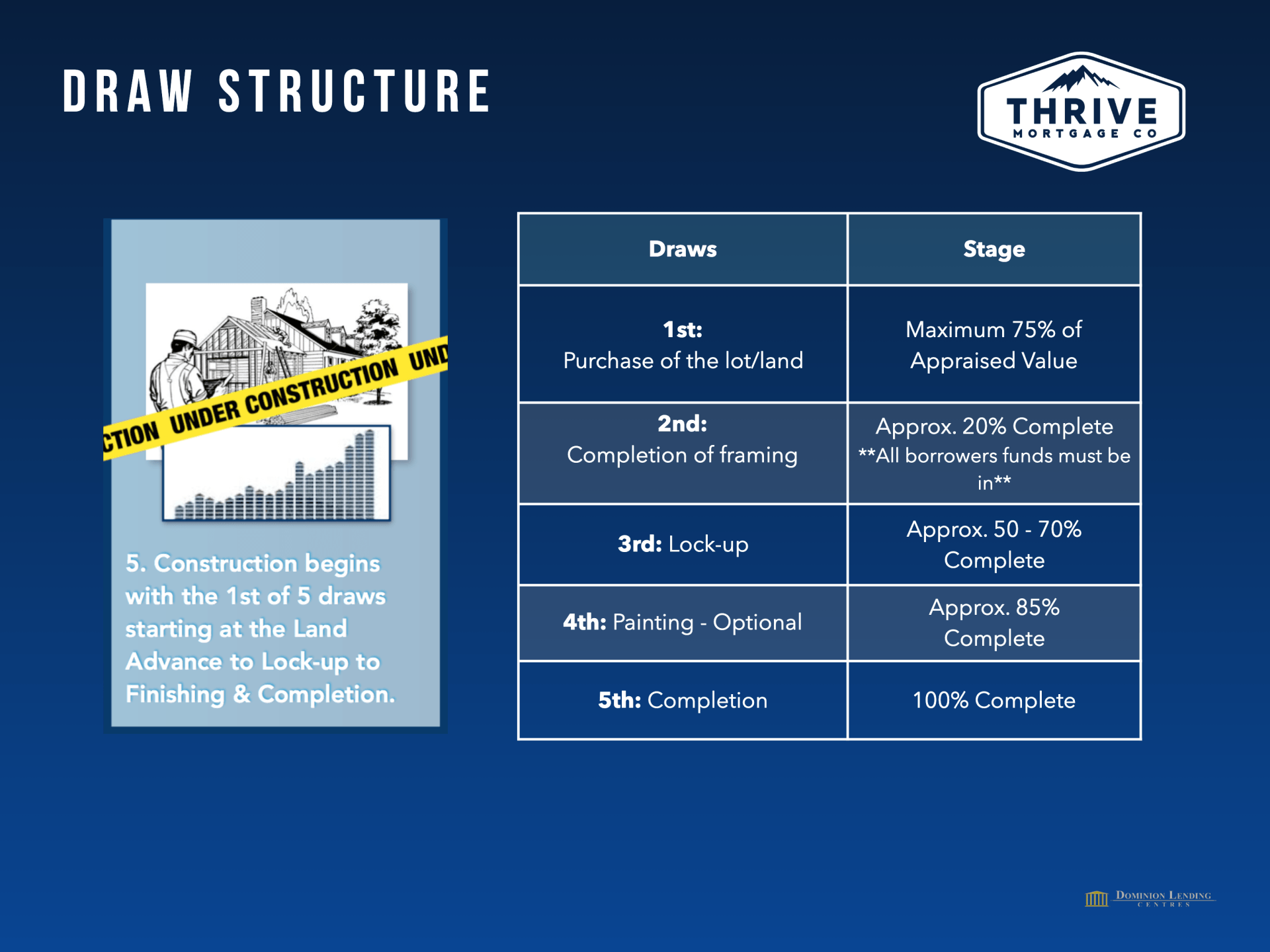

A draw schedule is the detailed payment plan associated with funding the construction of your home. Generally, funds are released once certain milestones have been reached throughout the build—in other words, you “draw” money from the total loan amount on an incremental basis. As work is completed, you are then able to pay the builder or contractor you’re working with.

Construction draws with private vs traditional lenders

When working with a traditional lender like a bank, you’re working with a very rigid schedule with one to five draws. If you haven’t reached a certain milestone completely, then no money will be released for the next stage under any circumstances.

For example, let’s say you’re expecting $150,000 to be released at the final stage (or the lock-up stage) and you submit a draw request to the bank. They will then take the time to review every document, order and approve inspections, and ensure that all of the work that was associated with the lock-up stage has been completed. If there is one document out of order or box left unchecked, you won’t receive a penny from them.

A rigid draw schedule may be reasonable for an individual with a lot of cash on hand and can push the project along as-needed on their own.

However, private lenders offer the average homeowner the flexibility they need to fund the construction of their home throughout any unforeseen obstacles.

With private lenders, there can be an unlimited number of draws. For example, you could receive one draw with just 1-2% of the project complete. In turn, you’ll never experience delays—saving you a ton of money in the process.

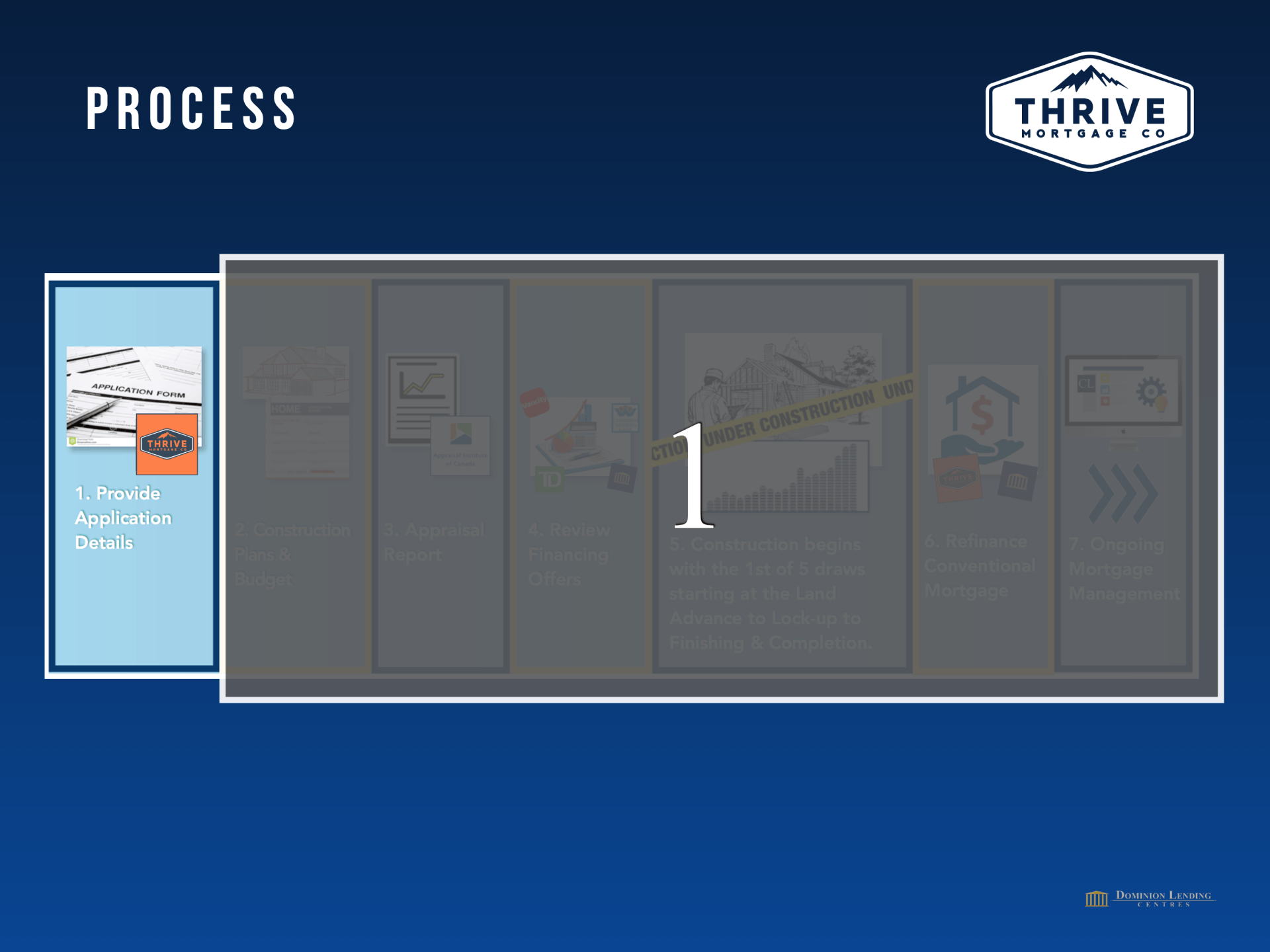

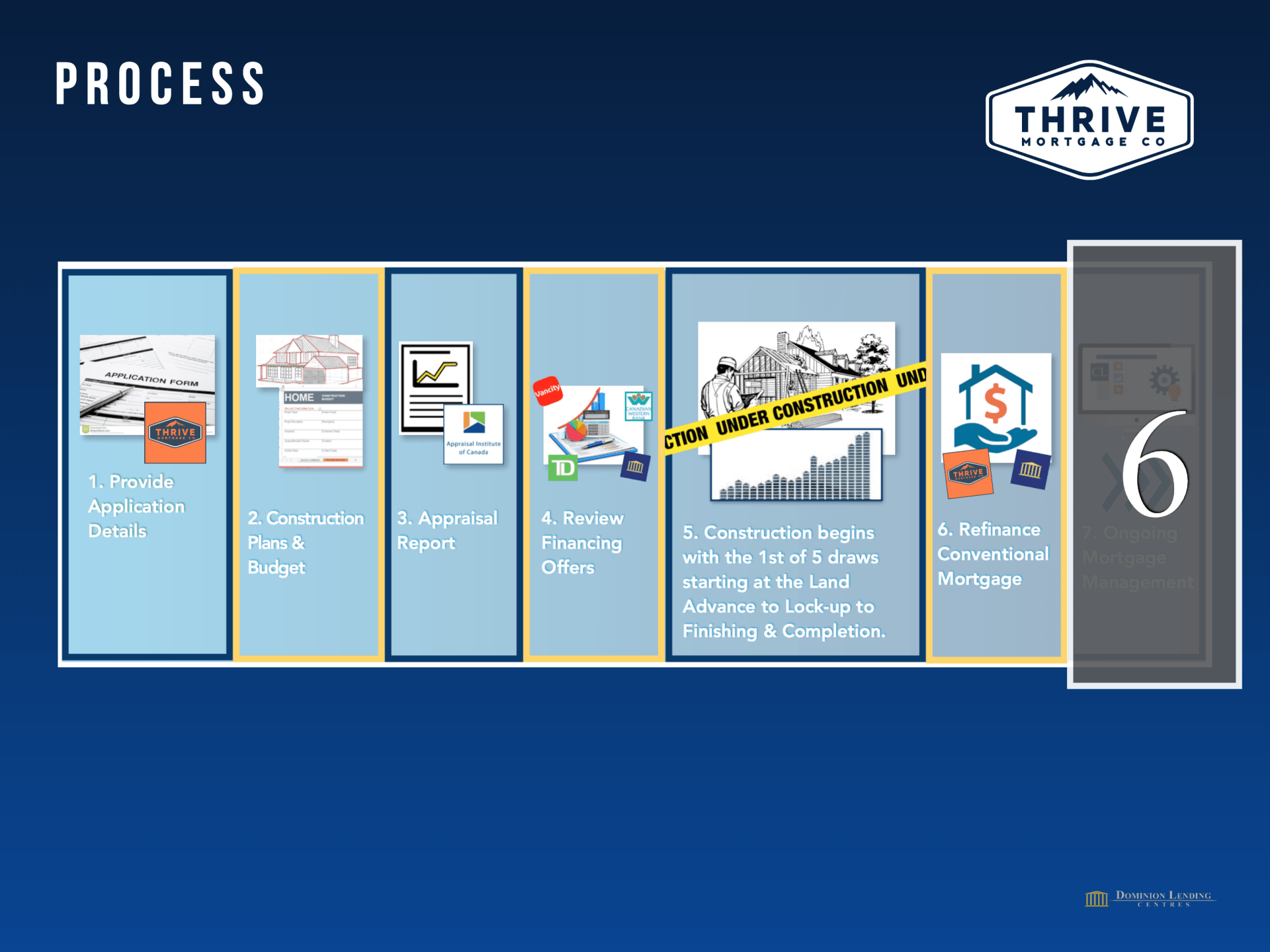

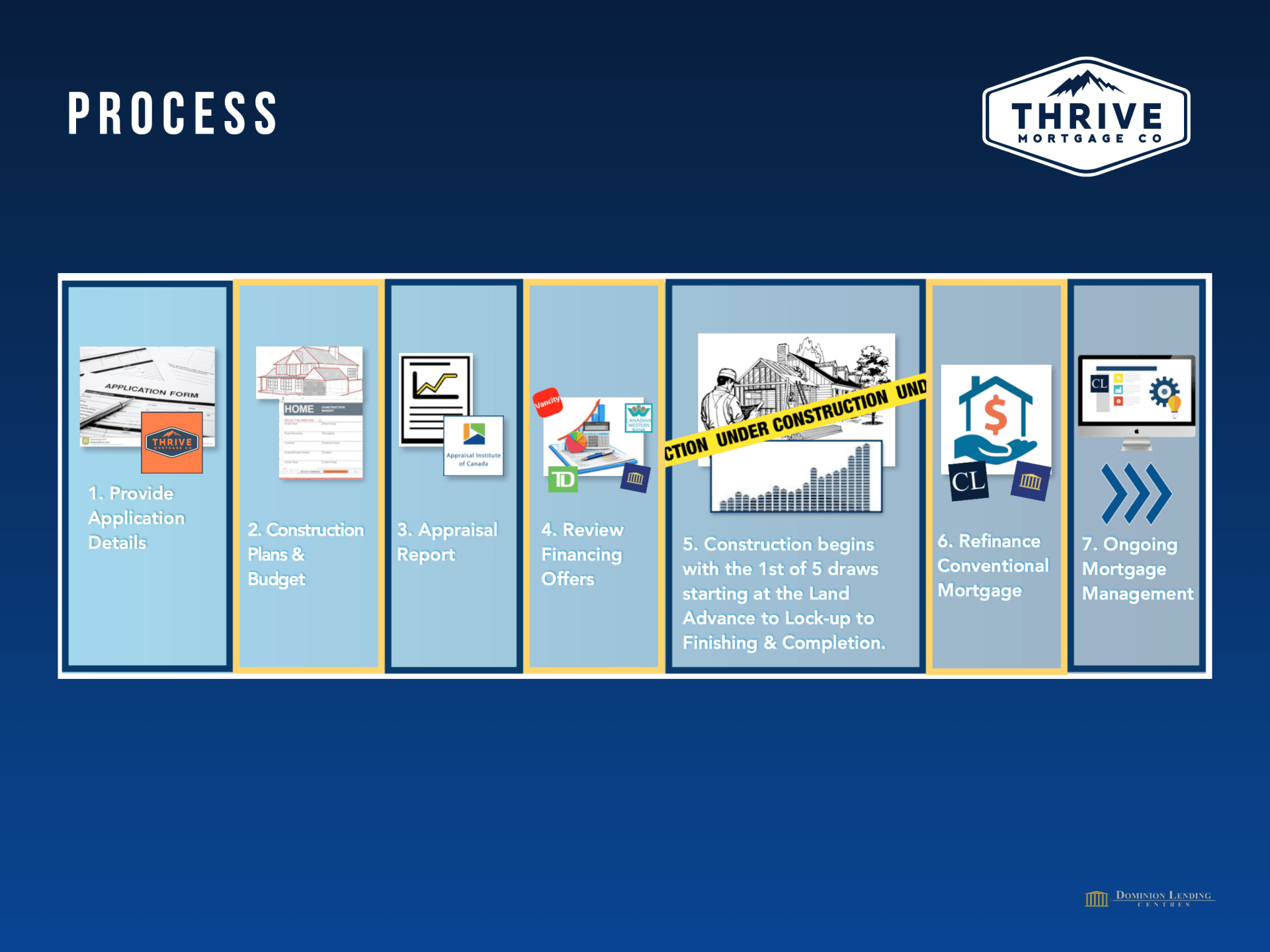

The steps to a successful building experience

Construction mortgages follow a specific series of steps that set you up for success if followed correctly.

1. Submitting your application and determining your qualification

Your application enables your mortgage broker to assess the size of loan that you can qualify for. This is where you’ll have a detailed conversation with the team that’s supporting you throughout this journey on all of the lender options available to you and building out a financial strategy. After all, before engaging a builder, you need to know exactly what you can spend and what the costs associated will be.

Another benefit of a private lender becomes clear at this stage: you are much more likely to be able to stay in your existing home and access the equity you need to build your new home.

Once the home is fully constructed, that’s when you can sell your existing home. This is an extremely common scenario at Thrive Mortgage Co.

2. Finding your dream property & team

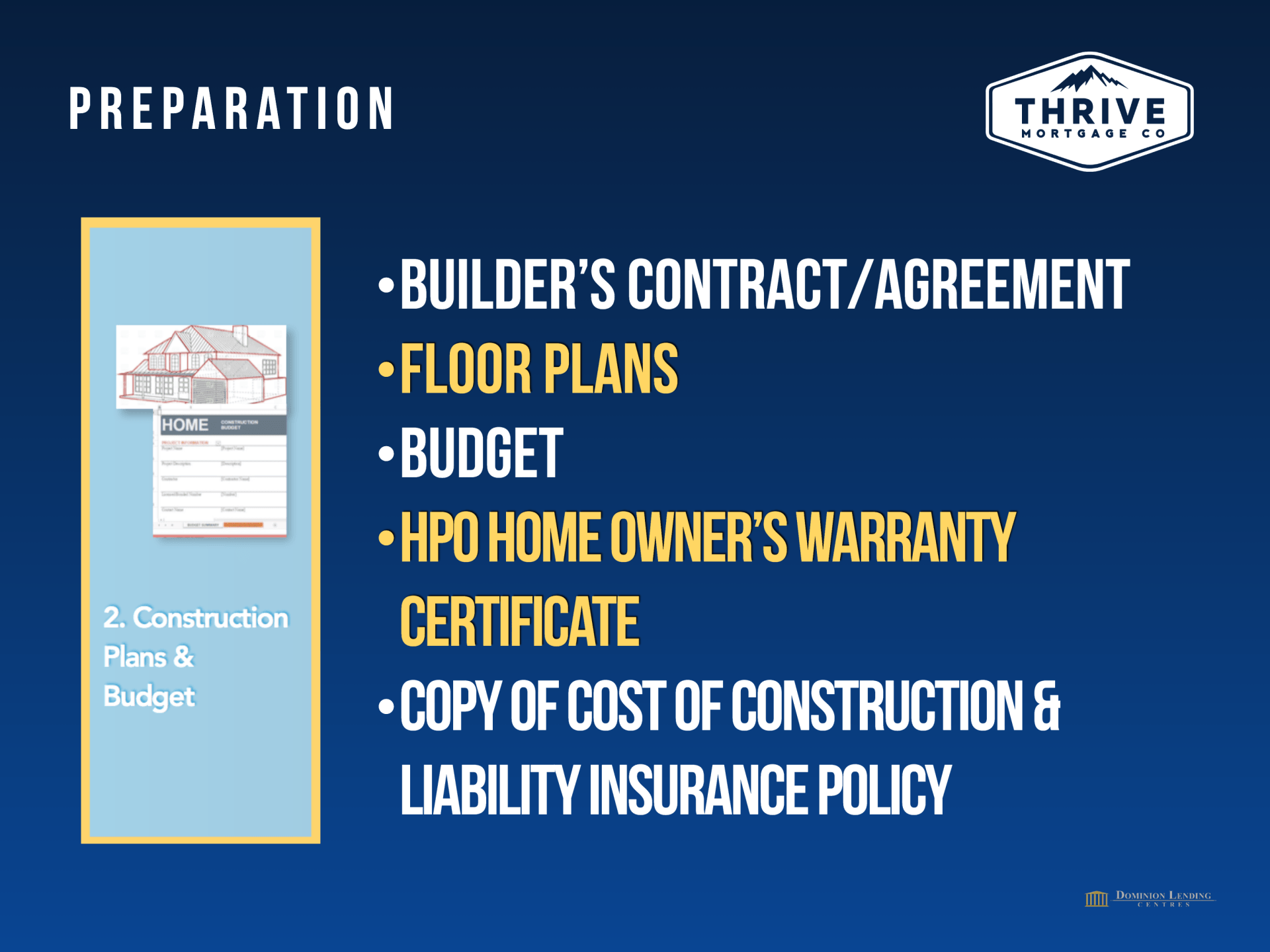

After securing your loan, that’s when you can go out and hunt for the property that you’ll build your future home on and find a qualified builder whose resume features at least a few successful projects. You’ll work through an in-depth builders contract that outlines all the terms to make sure you’re on the same page with timelines, costs, and everything else associated with the construction of your home. Your builder also helps you develop the budget and floor plans for your home—all of which is, of course, dependent on your financing.

Your designer will also come in at this stage. It’s extremely important to ensure that your designer and builder are introduced early and communication is flowing. “One of the biggest pitfalls we see here is clients will go out and design a home without consulting the builder,” shares Dean. “Your builder and designer must work together every step of the way.”

3. Securing an appraisal

The next part of the process is an appraisal report. An appraisal report is required for most transactions, like move-in ready homes. With construction financing, an appraisal is a slightly different.

There are two reports attached to an appraisal during the construction process. The first report assigns the value of the lot that you’re purchasing and the second will assign the value of the home once it’s complete—taking into account the floor plans and overall design that you developed with your team.

Taking both reports into account is extremely important. The lender wants to ensure that what you're building and how much money you're spending on it will both be marketable and profitable.

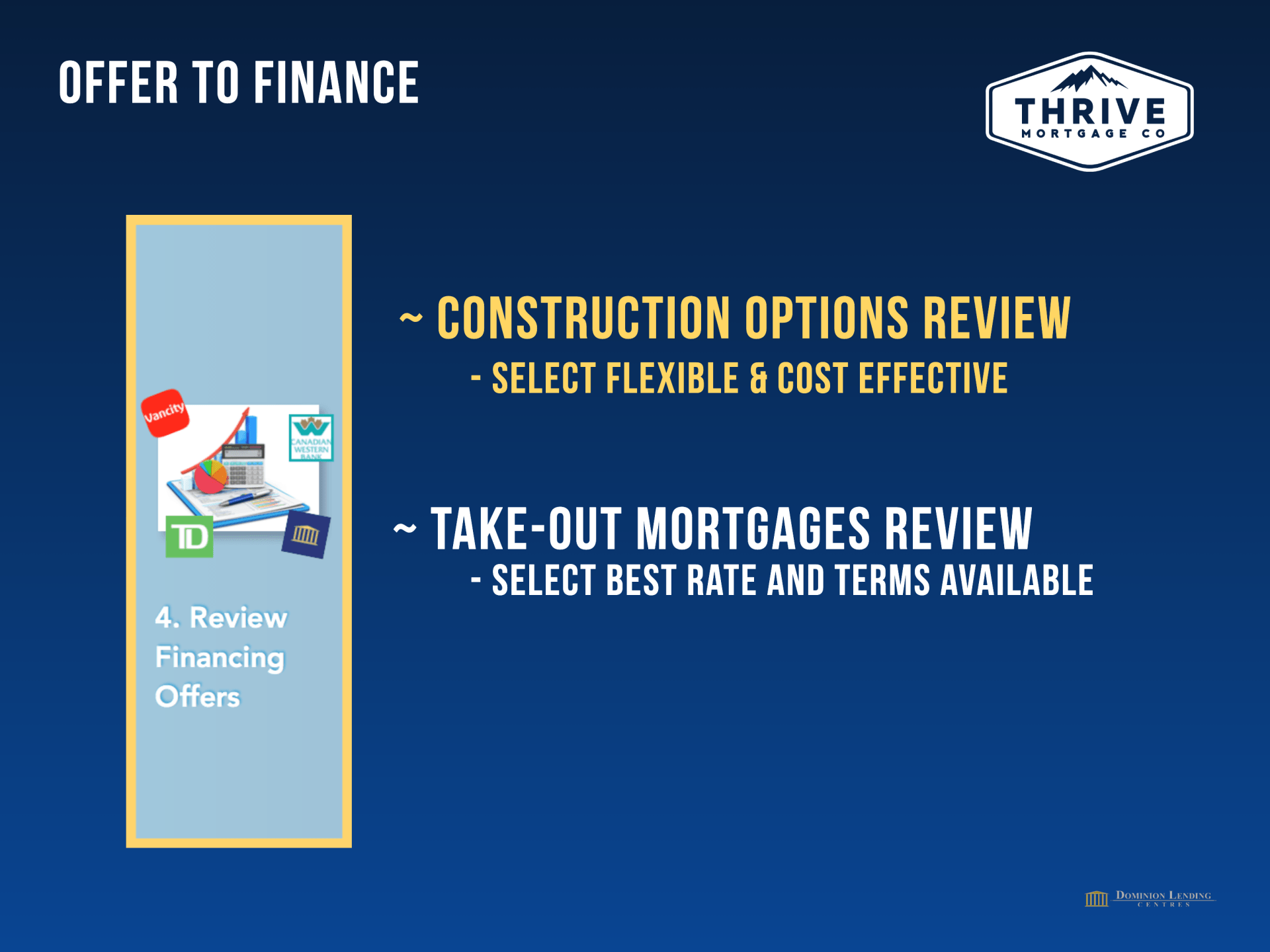

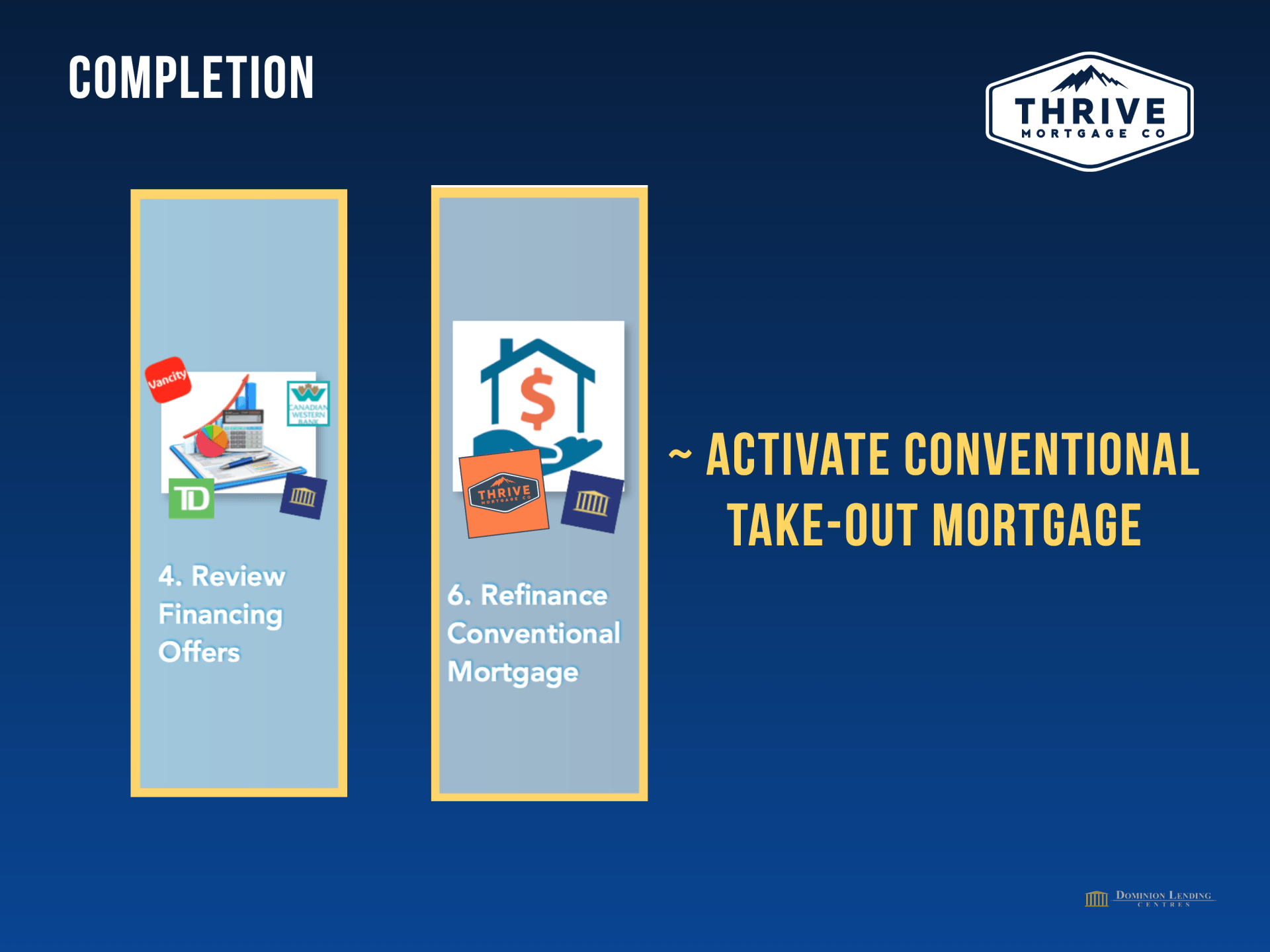

4. Reviewing your financing offers

While private lenders are ideal candidates for many construction mortgages, they’re not necessarily who you’ll end up with for your regular mortgage once your home is complete. In most circumstances, once you’ve moved into your home, you’ll be transitioned to a typical lender which will offer you lower interest rates than private lenders in the long-term.

You're not alone

The experts at Thrive Mortgage can help guide you through the process. Start the application process now to speak with an expert.

We will not do a credit check without your permission.

CLICK THROUGH THE SLIDES BELOW TO VIEW THE ENTIRE PROCESS

WATCH OUR PODCAST EPISODE ABOUT THE ENTIRE PROCESS!