VARIABLE RATES

We receive a lot of questions about how variable interest rates work, what impacts them, and where they make sense.

Below we have a breakdown of what you need to know, the current market outlook, and what to expect going forward!

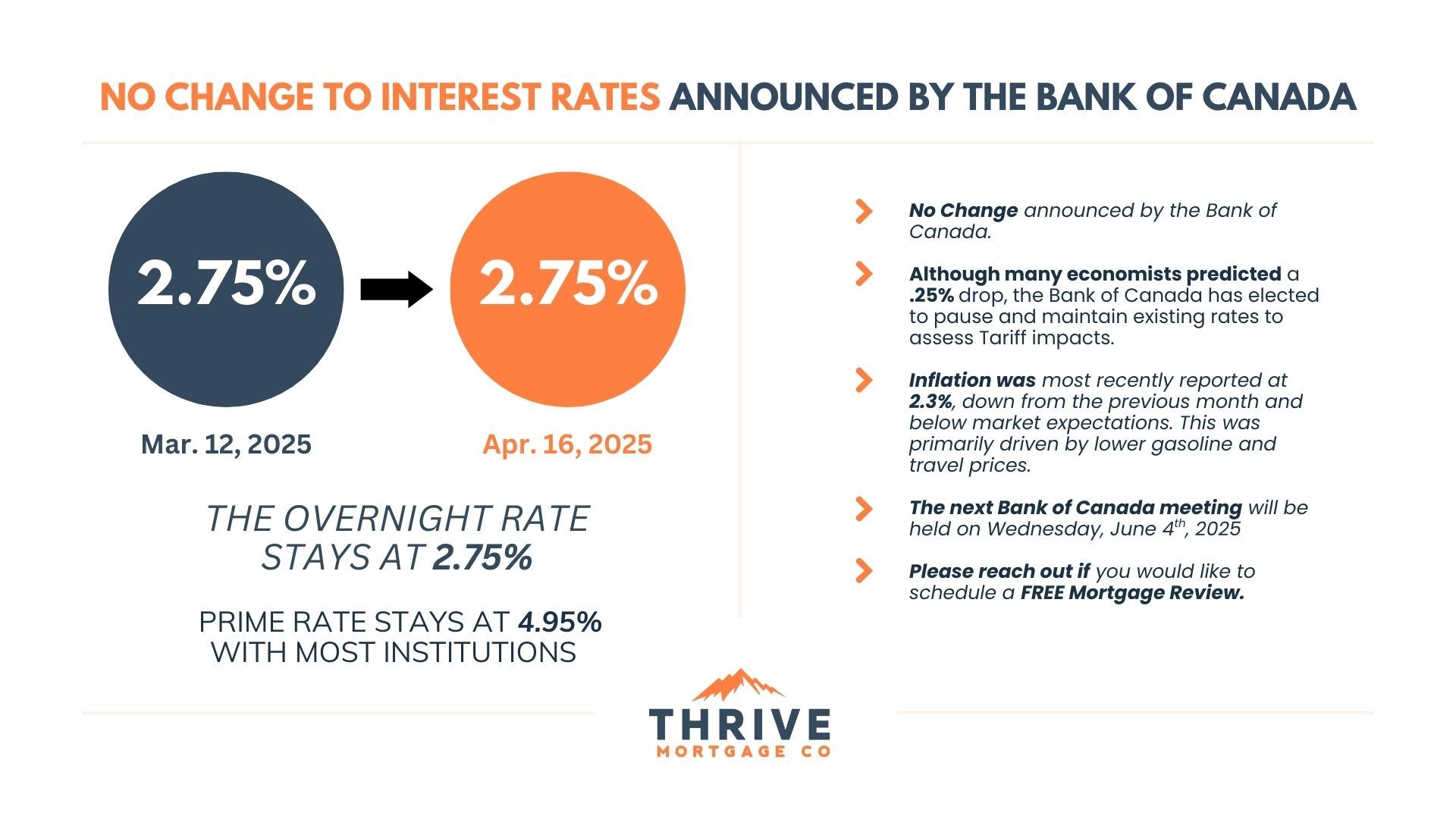

The Bank of Canada holds key rate at

4.95%

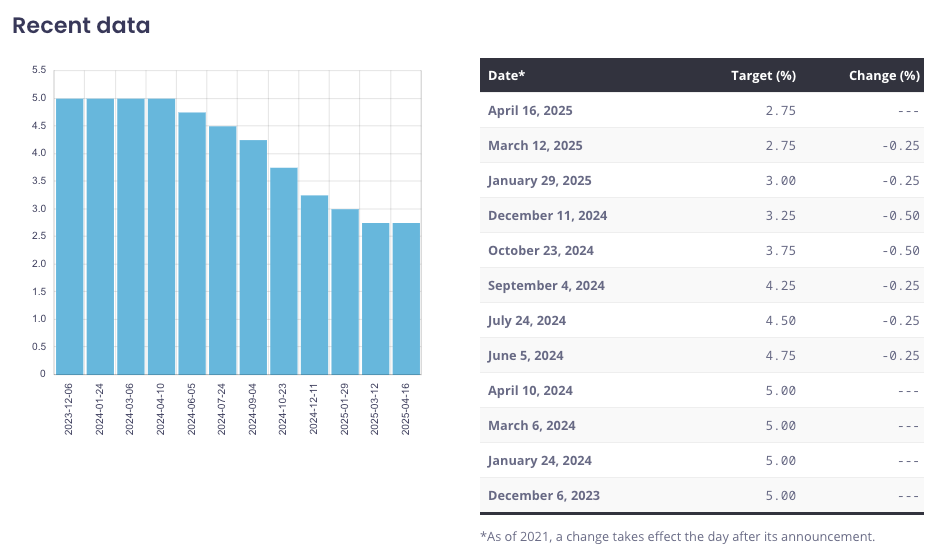

The Bank of Canada carries out monetary policy by influencing short-term interest rates.

It does this by adjusting the target for the overnight rate on eight fixed dates each year.

THE CHART BELOW SHOWS A RECENT HISTORY OF these adjustments ⬇️

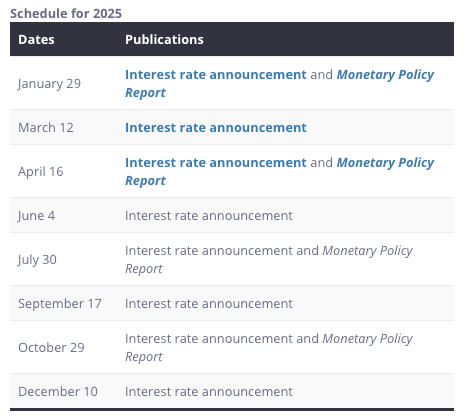

The schedule for Bank of Canada Rate Announcements

All information above was taken from the Bank of Canada website

Latest Update:

APril 16, 2025

- No Change announced by the Bank of Canada.

- Although many economists predicted a .25% drop, the Bank of Canada has elected to pause and maintain existing rates to assess Tariff impacts.

- Inflation was reported at 2.3% most recently, down from the previous month and below market expectations. Lower gasoline and travel prices primarily drove this.

- The next Bank of Canada meeting will be held on Wednesday, June 4th, 2025

- Please reach out if you would like to schedule a

FREE Mortgage Review.

⬇️

LEARN MORE ABOUT INTEREST RATES BELOW

⬇️

Questions to ask about whether to stay with a Variable

1) Would you be likely to refinance in the term?

If so, stay variable. You may refinance to take advantage of lower rates, qualify for buying another property, consolidate debt such as credit.

2) Would you possibly sell in the term?

If so, stay variable. An average penalty on a 5 year fixed penalty is 4%-6% of the balance of loan vs. 3 months of interest.

3) Would you be worried about a $12 per $100,000 of mortgage increase to payments for every .25% Bank of Canada move?

If not, stay variable.

4) Are you comfortable paying 1-1.50% more in interest to have a fixed payment?

If so, maybe consider a static payment variable first! Then consider the fixed rate if this is not an option.