Real Estate Investing Course

Learn everything you need to know to get started investing in real estate.

When it comes to a rental investment, you’re looking at a stream of income that requires work, yes—but a lot less work than flipping houses.

Initially, you may need to make improvements to the home to both increase its livability and, in turn, the monthly rent. You’ll also need to find suitable tenants (we’ll dig into this in the next chapter). That said, there are lots of ways to be relatively hands off with rental properties. Once tenants are secured and the home improvements are made, the hard work is largely complete.

If you want to grow your net worth, real estate investment is one of the best ways to get there.

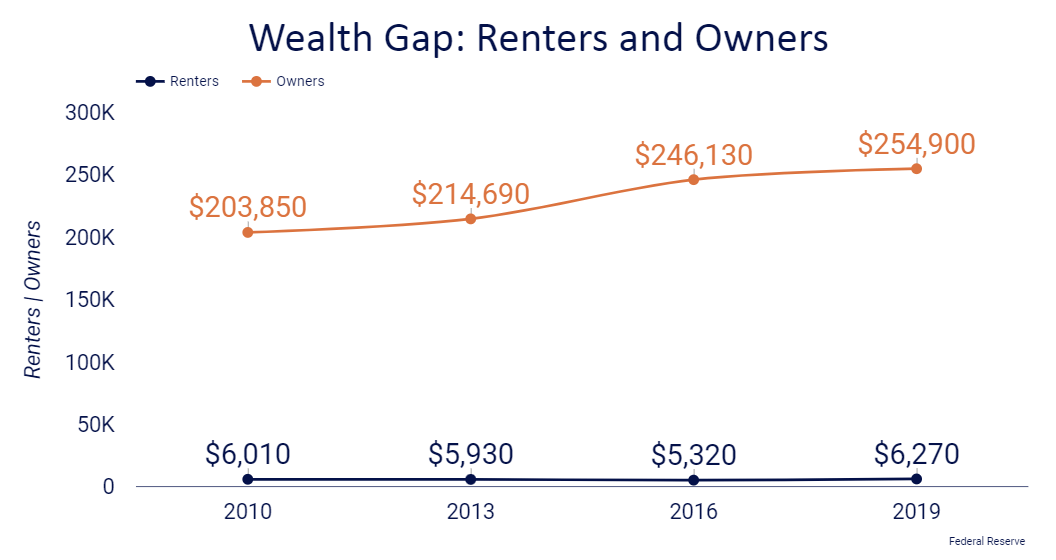

Over and over, statistics prove that those who own real estate have a higher net worth on average than those who don’t.

For example, the Federal Reserve released a staggering report demonstrating that homeowners in the United States had a median net worth of $255,000, while renters had a net worth of just $6,300—and this gap continues to widen.

Here in Canada, the real estate boom during the pandemic contributed to an increase in the net worth of households by $770 billion, but $730 billion went to those who owned their homes.

In other words, 95% of wealth created went to homeowners, while only 5% went to those who rent.

You’re comfortable with the work of a landlord, from fixing leaky faucets to dealing with tenant disputes—or you’re able to hire a property managerNew Paragraph

Three of the most popular rental properties include short-term, long-term, and senior living rentals. Let’s break down the pros & cons of each so you get a sense of which one is best for you.

Typically, vacation rentals or Airbnbs are considered “short term”. Short term rentals usually net a higher rental income, BUT it’s important to note that the property would need to be fully furnished and a regular cleaning service would be required.

| Pros | Cons |

|---|---|

| Pros: Potential for higher rental income and flexible tenancy to avoid squatters or poor tenants. Example: A 1-bedroom condo in Vancouver would typically rent for $1,800 to $,2200 per month as a long term rental. This same property could net well over double the amount of rent if positioned as a short term rental or an Airbnb. | More work for the landlord to regularly screen tenants as the short term rental includes higher turnover rates. Managing move-outs and ensuring you have a trusted and reliable cleaning service on call can be difficult. |

The traditional tenant is generally looking for a long term rental agreement, typically with a minimum of a 1 year lease. However, any term longer than 3 months is considered a long term rental. look for a long term rental agreement. Most of the time, property does not include furniture and the tenant provides their own furnishings.

| Pros: | Cons: |

|---|---|

| Potential for low maintenance and minimal time required to manage. | Low-income tenants who are unable to or do not pay rent can be difficult to manage. Evicting these individuals can also be a challenging process. |

This is arguably one of the most in-demand types of property and likely to increase in demand as the Baby Boomer generation enters their twilight years. Most Assisted Senior Living homes have 2-3 year waiting lists to be accepted into a unit. Catering to this demographic could be key to sourcing a fantastic tenant with potential for higher rent if the property has just one floor and was retrofitted with senior support equipment such as handles and walk-in bathtubs.

| Pros: | Cons: |

|---|---|

| Clear, stable demand means no shortage of potential tenants | Turnover is an unfortunate reality and managing tenants may require professional care |

When people ask, “How much can I make with a rental property?”, they should be asking a question with a bit more context: “How much can I take home as income after all of my expenses related to owning this property are paid?”

Remember,

income = revenue - expenses.

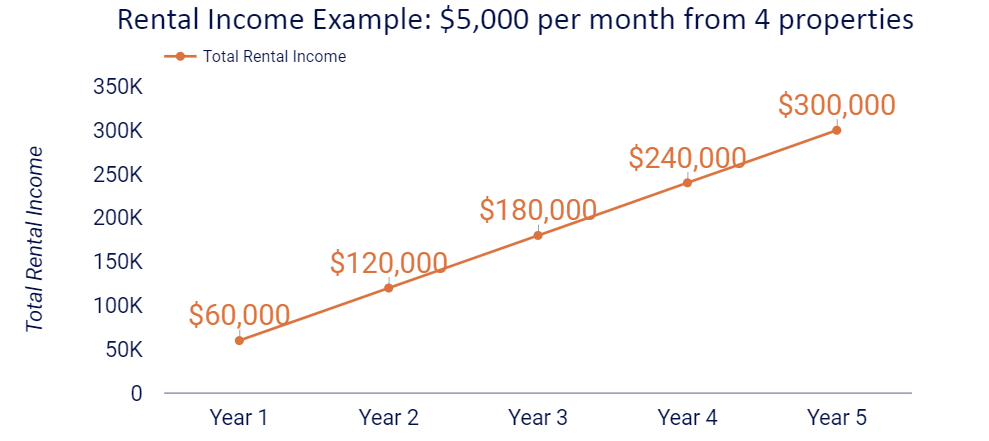

For example, if you generated $5,000 per month from four investment properties, you would earn $60,000

REVENUE per year, or $300,000 after 5 years.

There are a few different types of expenses you need to consider in this equation. First up, the expenses related to purchasing your investment property. You’ll need to take into account expenses like:

Second, there are expenses related to the loan you take out with your bank or private lender (assuming you’re not paying for your rental property with straight up cash).

Last, but not least, there are the

monthly expenses

related to keeping your property in good condition for the tenants and your own property’s value. These could include:

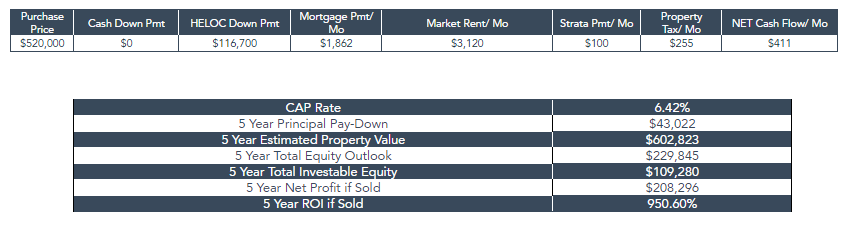

Is your head spinning? Let’s put it back on straight! This

simple rental returns calculator will do all of the hard work for you when it comes to figuring out how much you’ll make each month in

net income.

In the context of your rental property: rental income = monthly rent paid by your tenants - monthly expenses related to the rental property.

So important to understand your cashflow AFTER subtracting costs from your revenue.

You can use our calculator to generate your own investment property analysis. Just make a copy of the template, input a few basic details about the property, and we'll calculate the rest.

In the example below, a Mortgage of $1,862 would generate $411 after deducting costs.

When we’re looking

solely at monthly expenses and monthly incomes, we’re looking at the capitalization rate of a rental property. In other words, how much can you

capitalize

on the property every month? The capitalization rate or “cap rate” of a property also helps you determine how much time you need to make back what you paid to purchase the property (and make back your investment).

Depending on where you live, a good cap rate is considered between

4% and 12%. It’s worth looking into this rate before you purchase a rental property to figure out if it’s over or under-valued. One thing’s for sure: your cap rate should always be more than the cost of financing. For example, if your mortgage rate is 3% but the property’s cap rate is below or equal to 3%, you are likely going to lose money on that property.

Exercise:

Try looking at properties in your area on a site like Zoocasa or Realtor.ca and determine their cap rate with

this easy cap rate calculator.

One of the most common questions related to rental income is whether you need to claim it on your tax returns. Well, the answer is a definite yes. Rental income does need to be claimed during tax season.

If you don’t claim this income on your taxes, you’re putting yourself at risk of a CRA audit which can trigger fines, penalties and large tax bills. Most lending institutions also require the rental income to be claimed in order to use it towards your qualification if you’re applying for further borrowing.

An important point to understand, though, is that you only need to pay tax on the

net rental income claimed. You’ll have both a gross and net rental income showing on your tax return, but you’re only paying taxes on the latter. Gross rental income can be reduced by claiming expenses related to the property, like property repairs, utilities, and insurance.

Additionally, rental income will be taxed at the individual's marginal tax rate. In other words, your personal income plus net rental income will create your total tax rate. Corporate tax rates may differ if the property is held in a corporation.

So, what are the kinds of expenses related to a rental property? We covered a few of the most common ones above, but here’s a more exhaustive look:

Mortgage interest is tax-deductible dependent on how much of the property is being used as an investment.

For example, if the property is 100% rented, then 100% of the mortgage interest can be deducted from gross rental income. If the property is a personal residence with a rental suite, only the percentage of the property dedicated to the rental suite can be applied to the interest paid for deduction purposes.

The Residential Tenancy Branch (or RTB) is the provincial authority over landlords and tenants. They help both landlords and tenants understand their respective rights and responsibilities, and provides both parties with dispute resolution services.

They provide information across a number of areas, including:

To put it simply, these folks help to enforce and provide information on the tenancy law in B.C.

It’s worth reviewing

this guide that the RTB released, especially when considering whether you might want to outsource property management so that someone else makes sure that you & your tenants are adhering to the tenancy law.

Understand: