Beginner's Guide to House Flipping

We’re going to let you in on a secret: you don’t need a TV crew or decades of experience behind you to successfully flip a house. In fact, flipping houses is the perfect way to get started in real estate investment if you want to make larger profits in a relatively short amount of time.

As long as you have the time to do your research and the right team around you, flipping houses can be a lucrative path to financial wealth.

First, how long does it take to flip a house?

One of the most important things to know upfront about house flipping is that it takes time to do right.

Generally, it takes 4 to 6 months to flip a house successfully, which includes:

- Purchasing the property itself.

This can take anywhere from at least one week (if purchasing with cash) to a month (if purchasing with a loan). Related: Guide to

buying an investment property.

- Making the necessary improvements to boost its value.

The time this step takes will vary on the amount of work you deem the property needs, and your budget.

- Putting your home back on the market and selling it (ideally for a profit!).

Ideally, you should be working with an experienced real estate agent who knows the market well and will support you with determining the best listing price—and showcasing the value of your property flip most effectively. Putting together marketing materials and finding a buyer can take a few weeks to a few months.

- You got the buyer—now you close the deal.

If you’re working with an average buyer, they’ll likely purchase your flip with a loan. This can take 1 to 2 months to secure.

What should I look for in a property?

- Location, location, location!

There is no quicker way to lose out on potential profits than getting the location wrong. Location affects both the price you purchase a home at and the price you can sell the home at.

In general, you want to purchase a property in an area that buyers are beginning to flock to, so pay close attention to the liveability factors that buyers are seeking out.

For example, 8 out of 10 British Columbians in the

2020 RE/MAX Liveability Survey report wanting more access to green spaces & dog parks. B.C. residents are also beginning to turn to properties outside of the city where they can have a larger space for remote work and even patios to enjoy. This is the kind of resource you should be referring to when evaluating a property.

- Think about what your target buyer needs

If you’ve ever considered launching a business, you’ll be familiar with the importance of clearly setting your target customer. Everything you do from that point on needs to serve their needs and address their challenges. The same goes for house flipping.

For example, if you’re purchasing a home in a neighbourhood flush with great schools and access to transit, you may want to look for a home that can be renovated based on the needs of a young family. Is there room to add an additional bedroom? Is there enough storage space, and could you add some more? Is there a backyard or patio that you could provide landscaping to enhance their liveability?

THRIVE TIP: Decide who your target buyer is and step into their shoes when you're looking for a property to purchase. Don't think about anyone else but your target buyer.

- The extent of repairs needed

When you’re just getting started with house flipping, you may be on a tight budget. This means that you won’t necessarily be able to afford the homes that need a thorough gutting. Instead, you’ll want to look for a property that has a scope of repairs that you feel comfortable with.

How much can I make when flipping a house?

The costs associated with flipping a house successfully can pile up, but as long as you plan for them in advance, you can still make ample returns on your investment.

First, estimate the after-repair value of your home.

When looking at a property, you should be sitting down and calculating every repair you want to make based on the value it will bring to the property. For example, is the roof leaking? That’s a priority. Are the appliances outdated? That’s the next priority. (We have a great list of the top renovations/repairs you should make to a house you’re flipping below.)

Tally all of these repairs up in terms of the value they’ll bring to the home. That’s your after-repair value (ARV).

Now comes the 70% rule.

Take 70% of the after-repair value and subtract the cost of repairs from it. This is the maximum amount you should pay for the property.

Let’s say you’re looking at a home and work out its ARV to be $500,000. Multiply this by .7 to get 70% of its ARV. You’re left with $350,000. Now, suppose it cost $50,000 to complete all the repairs. $350,000 with $50,000 subtracted is $300,000.

That means the most you should pay for this property is $300,000.

Don’t forget taxes!

Unlike a rental property, if you purchase a home with the sole intention of selling it for a profit, the CRA considers this business income.

As a result, the entire income you earn from selling your flip will be subject to taxation.

When eventually selling a rental property, the sale would be considered capital gains, meaning that you’d only be taxed at the 50% rate.

THRIVE TIP: When you’re getting into the business of house flipping, it’s important to set yourself up for success by chatting with an accountant ahead of time.

What are the most cost-effective and value-increasing renovations to make?

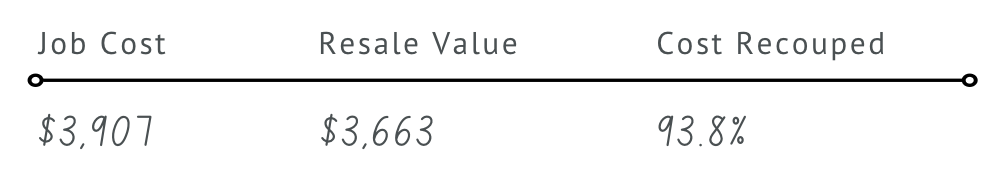

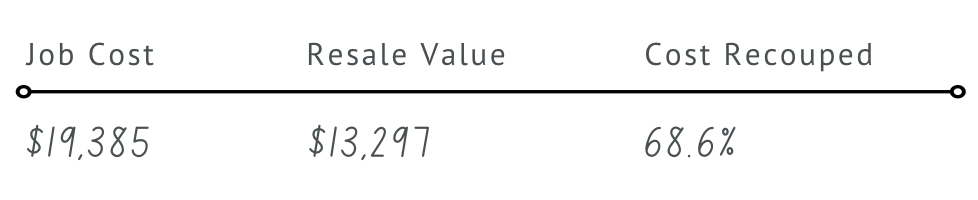

Garage doors

According to the

2021 Remodeling Cost vs Value Report, updating the garage door is the single best improvement you can make to a home when it comes to the return on investment.New Paragraph

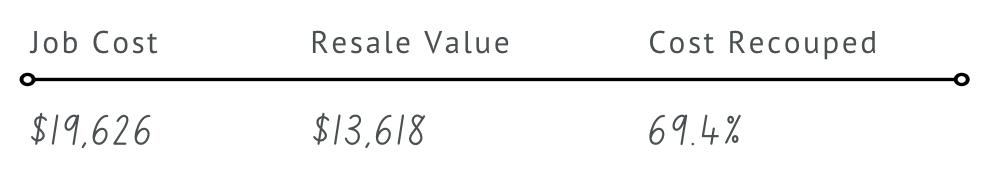

Siding upgrades

When you upgrade the siding of a home, the entire home is given an instant lift. While you want the siding to be clean and dent-free, make sure to take into account the colour, too. Go for what will appeal to your target buyer.

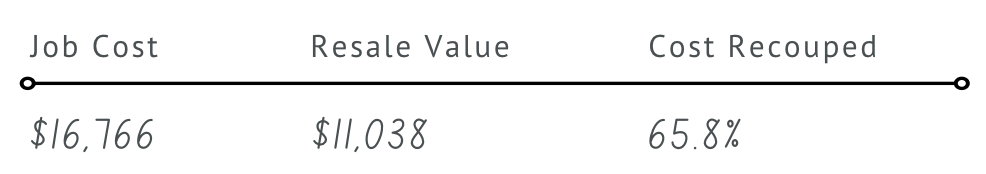

Minor kitchen remodeling

Even if the exterior of a home looks sleek as can be, nothing will date a home more than an old kitchen—not to mention turn off potential buyers as they tally up the costs of a future renovation that they'd need to tackle on their own.New Paragraph

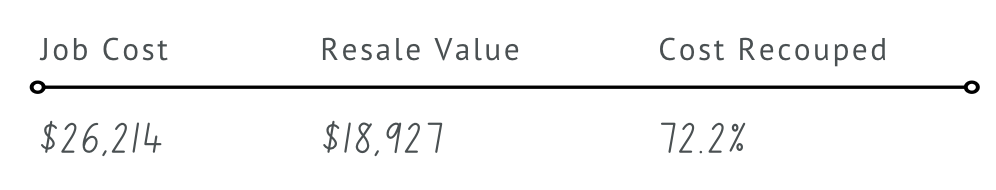

Window replacement

While the average home buyer doesn't immediately think about windows,

home inspectors do. This can scare buyers right off when they hear about the hefty price tag associated with most window replacements & repairs. Stay ahead of this challenging scenario with energy-efficient windows, which increase a property's value and promise lower energy bills.New Paragraph

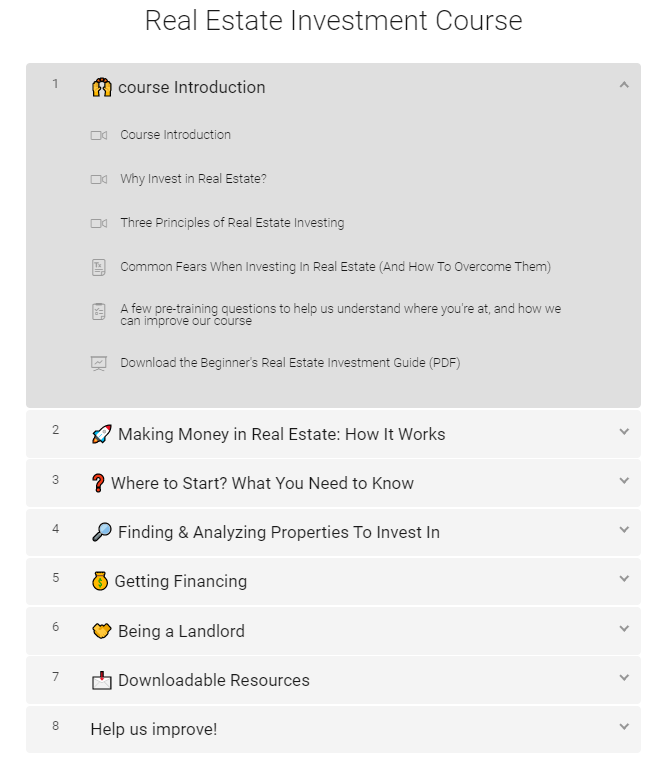

Take our Real Estate Investment course for free!

Take the course for free

Key takeaways:

- A clear understanding of why people invest in real estate

- The basics of the different types of real estate investment

- A well-informed opinion on which type of real estate investment is best for you

- The best ways to secure your down payment

- Which type of mortgage financing is right for your situation

- Optimizing your equity—and learning exactly what equity is!

- All of the costs you should be aware of, including a personal cash flow calculator